Year

2014

Role

- Lead UI designer

Deliverables

- Strategy

- User research

- Product experience

- User interface

- Design system

Enable the future

With high anxiety and focus on the day to day customers find it hard to understand where their money goes. They are unsure if their income covers their daily living, or what life could be debt free, and they are considering bigger things like retirement.

The CommBank Tablet App aimed to empower customers with a financial companion that can looks out for them, educates them, inspires them and enables them to live the future that they want.

Role

Lead UI Designer

Responsible for defining the problem space, and delivering the strategic experience roadmap. This roadmap would allow product owners to prioritise and deliver the MVP across 8 scrum teams.

Archetypes

Who was tablet designing for?

Impulsive Survivor

“My plans are very short term, if I have money today I will spend it very soon – but I know I should be more mature about managing my money.”

Coaster

“We are neither rich nor poor. Our parents taught us to enjoy life, not just survive.”

Maximiser

“I enjoy being engaged closely in my complex finances and have enough confidence to turn the knob. I can see the results of my financial decisions.”

Archetype detail

Maximiser

Needs

- Manage the investments

- Make sure the portfolio is diversified and effective

- Has control of their superannuation

- Works the system to their benefit

Decision making

- Likes to maximise their wealth for the future by comparing market trend and insight

- Uses their own systems for analysis, tracking

and reporting - Relies on themselves to manage their own money

Journey mapping

Identifying opportunity along the customer journey

Using a customer journey map helps generate the story through customer’s experience: from initial awareness, through the process of engagement and into a long-term advocacy.

It helps me bring empathy and understanding of what drives the user’s feelings, motivations along each touchpoint.

Desirability

Exploring solutions to fit customer needs

- Allow long term investment to be controlled, empowering customers to make informed decisions in their next move in growing wealth.

- Placing accounts upfront gives customers

the confidence to know how they’re tracking. - Simplified account detail screens make things easier to understand.

- Insights on account detail pages help reduce anxiety when predicting future payments and what is available and safe to spend/save.

- Timely messages give customer the control and nudges they need to plan for the future.

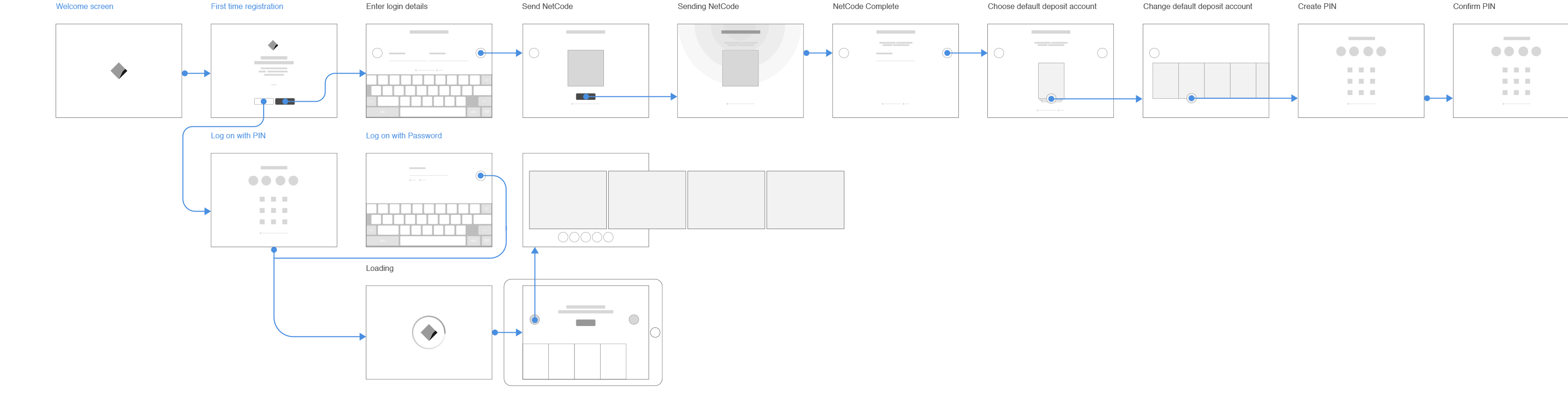

Experience model

High level IA and flow diagram

Principles

Product experience principles

Establishing the guiding experience principles early in the design process it enabled 12 designers to validate their solutions and help mapped their designs to the broader strategy ensuring the experience remained cohesive.

- Give me perspective

- See over the horizon

- Look around Corners

- Playful experimentation

- Power of my money

Aggressively simple

Simple can be harder than complex. You have to work really hard at it. Take away the things that distract from it’s function. Tear it down piece by piece, right down to it’s purest form. That is – Aggressively Simple™.

Messaging

- Timely and tailored

- Don’t make me work

- Tangible and emotive

- Ambiant

- Inform and empower

- Build momentum

Interaction

- Delight

- Small steps

- Provide a solution

- Demonstrate the benefits

- Focus on what’s important

- Easily reversible

- Rich and native

- Opt-in and trial

- Show your workings

- Reduce friction

UI

- Motion must provide meaning

- Objects are real

- Reductive

- Open to space

- Delightful

- Depth of field

- Enchanting

- Responsive

- Story telling

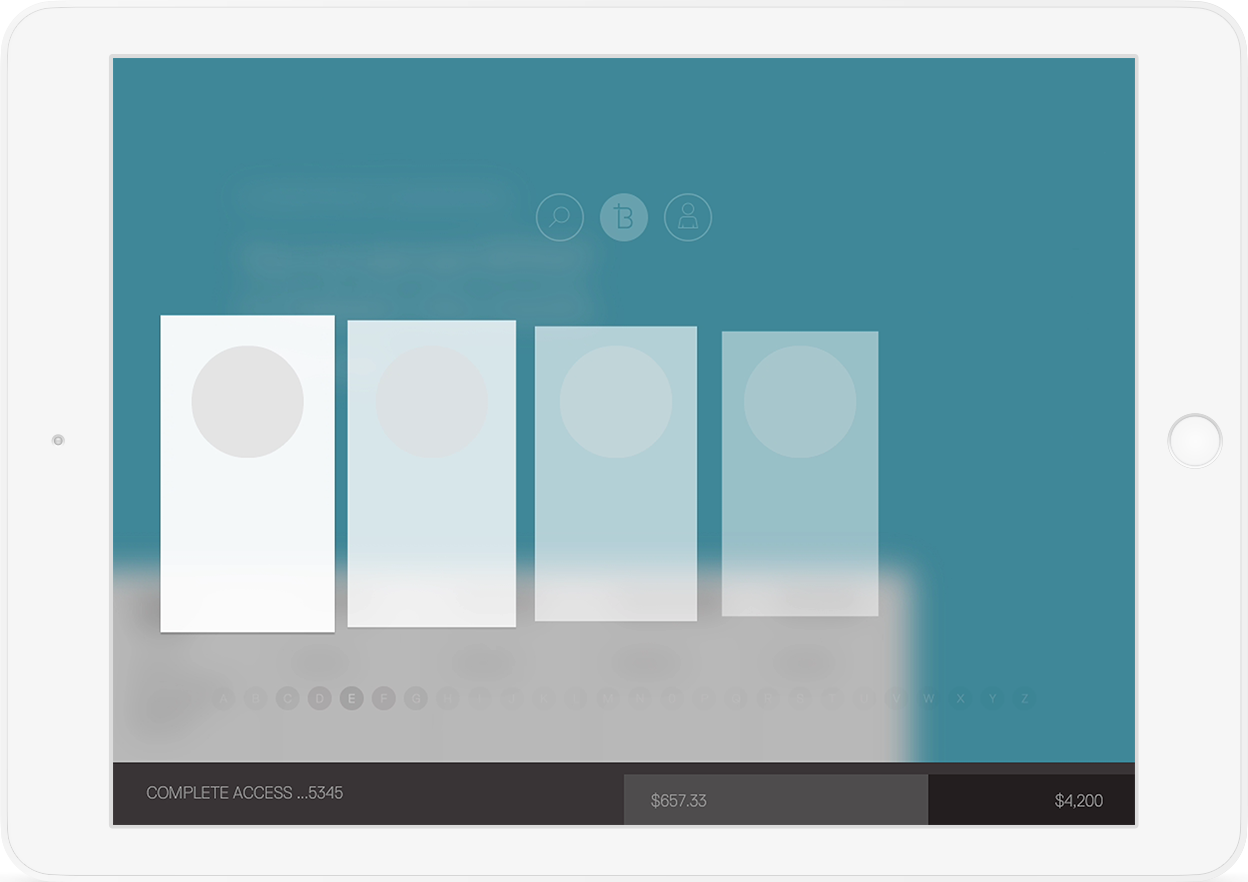

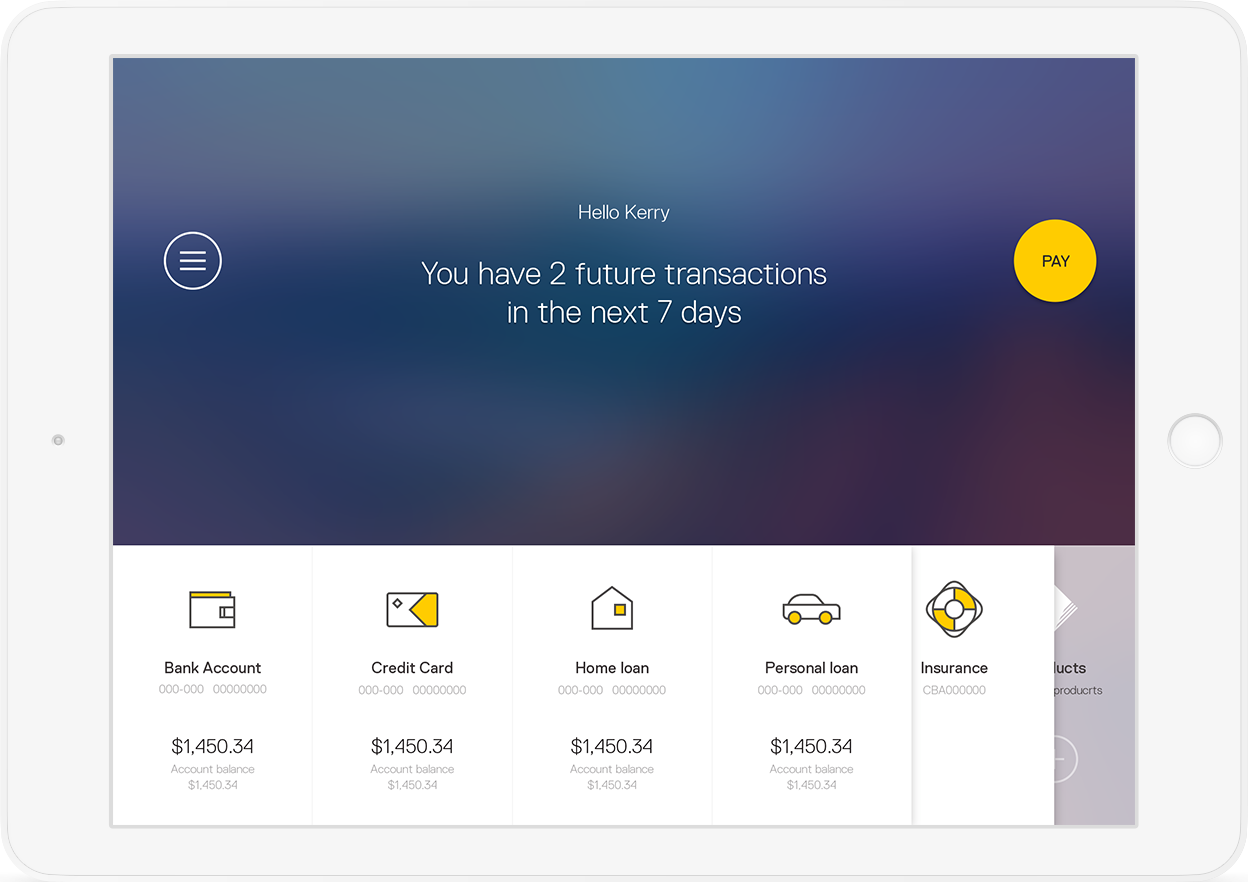

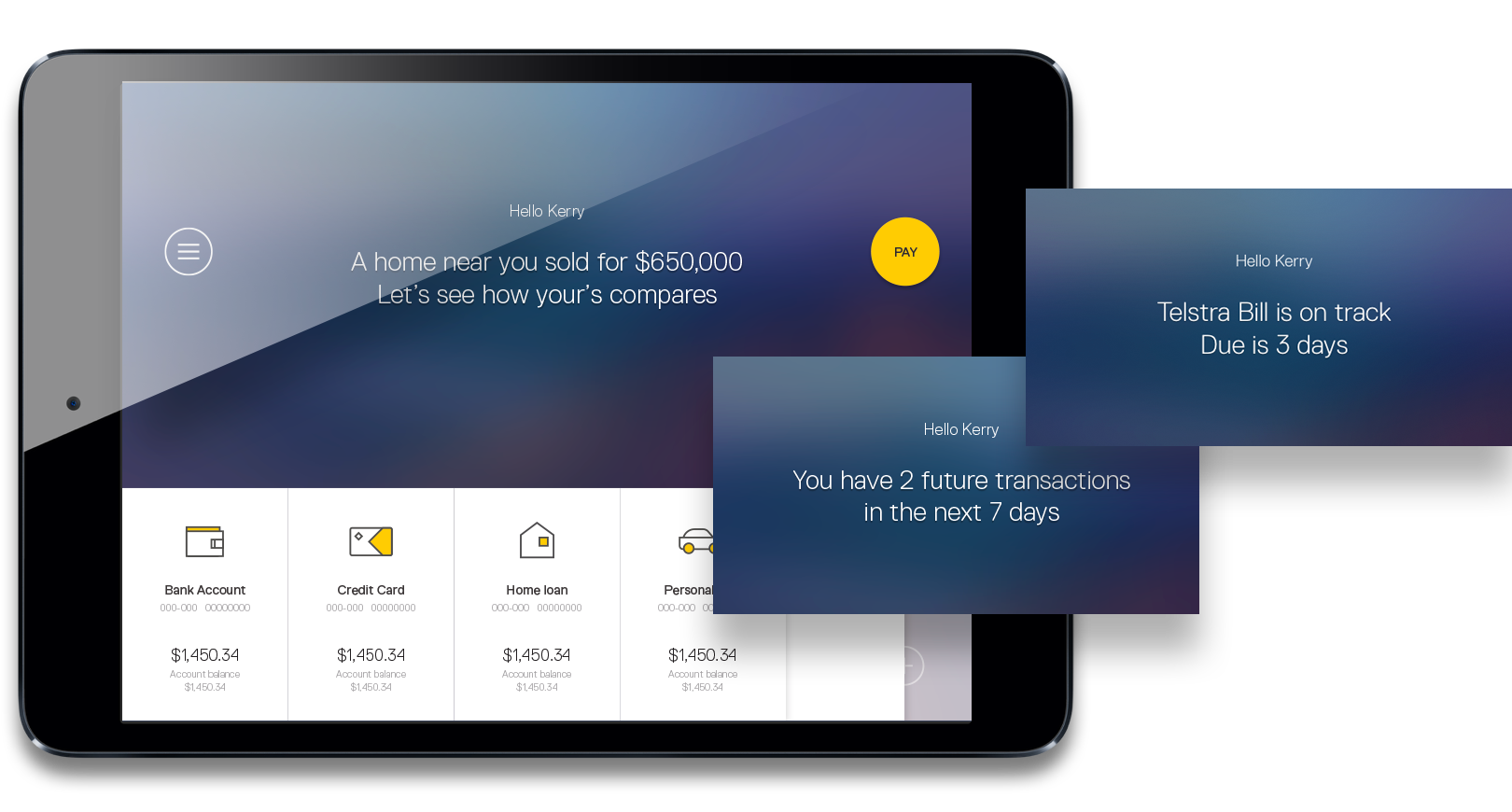

Experience

Make me aware of the important things

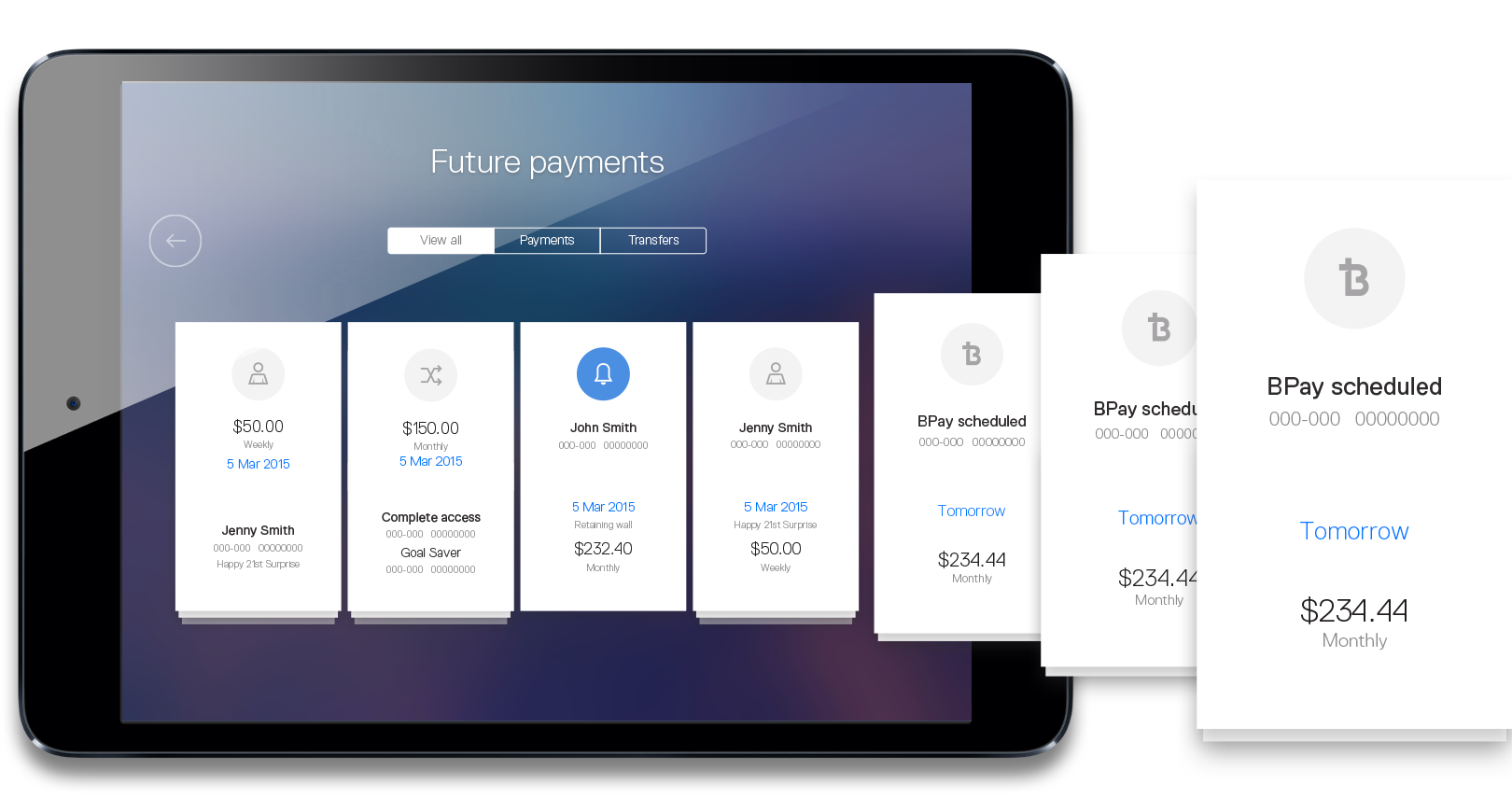

Contextual messaging tailored to each customers unique circumstance was used as navigation, and to nudge them into action. Eg Upcoming payments alerts.

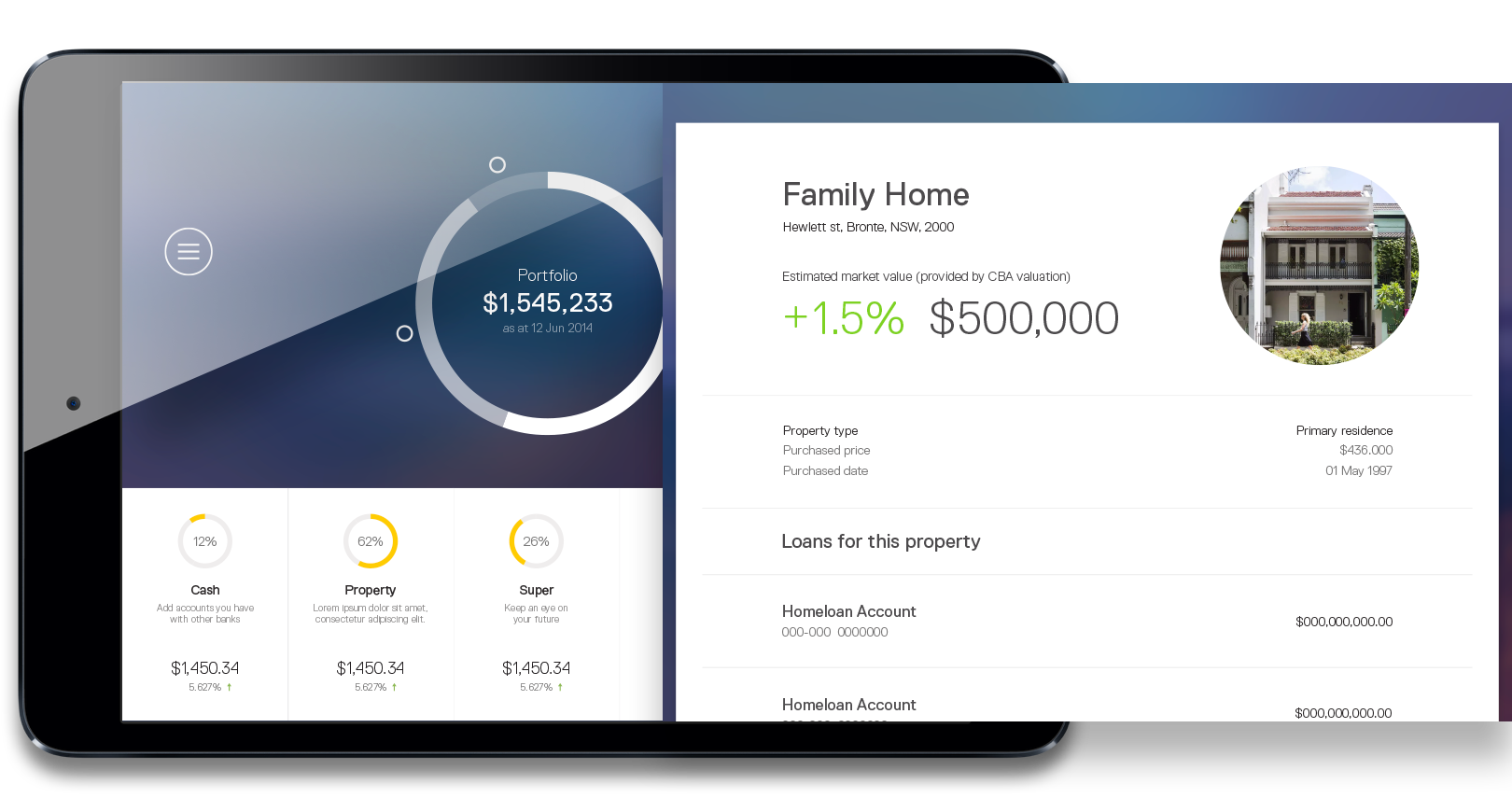

Experience

Give me perspective

Giving customers the full picture of their wealth. Informing them to identify and focus on the important aspects of their life.

Experience

Help me grow and maximise my future

In depth real time share prices, news and insights give customers the control they need to be up to date, grow their wealth, and show them the power of their money.

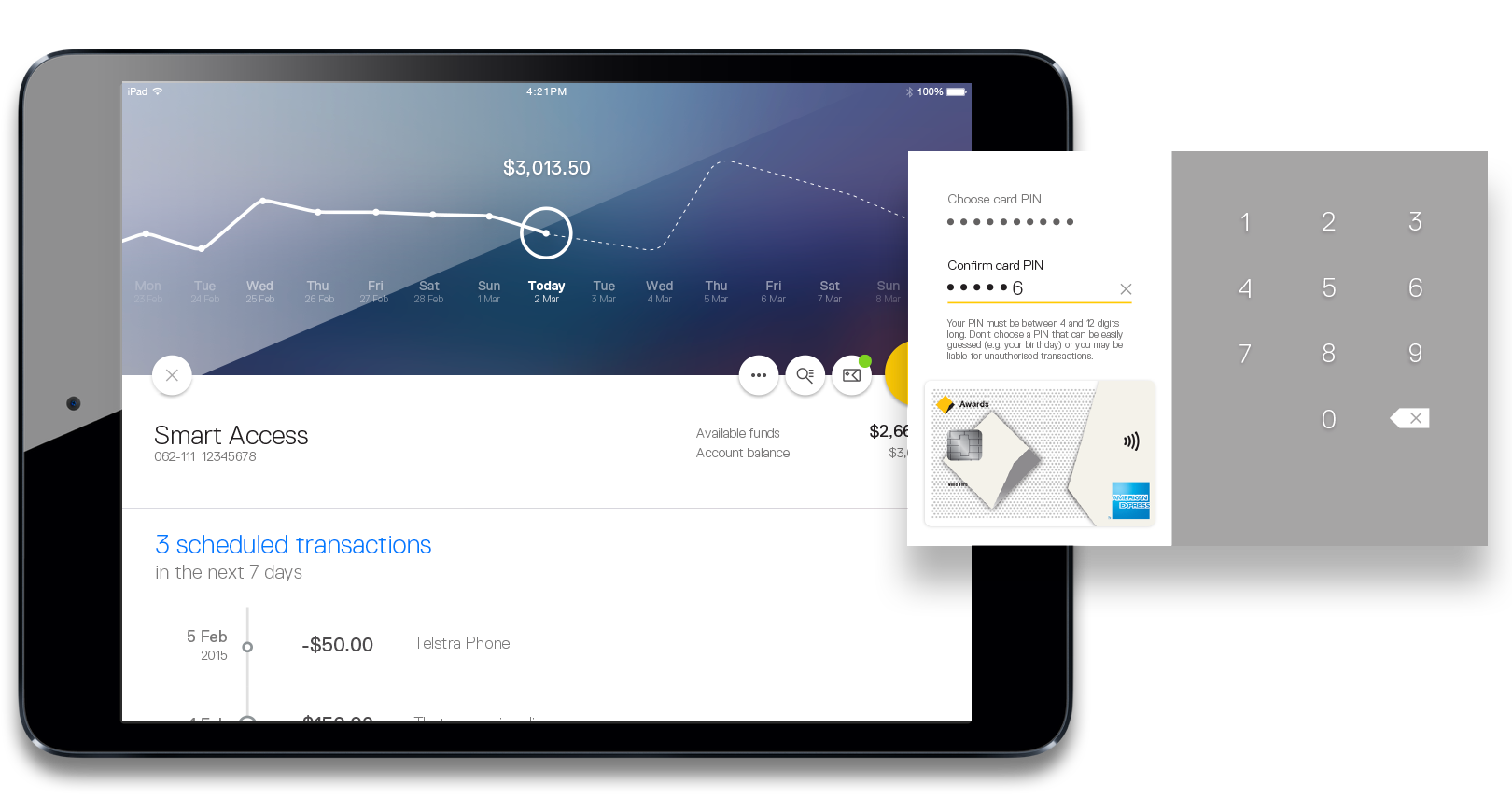

Experience

Give me insight to predict my spend

Spend tracker gives customers a running account balance with the insight to predict salary credits. Helping to keep them informed in how to manage their cash flow in the future.

Experience

Prepare me for the unexpected

Automated bill payments and bill bucketing ensures there is always enough buffer to cover upcoming expenses.

Language

The guide to style

Dimension is a living visual language that captures the principles of good design and creates meaning in our approach at CBA.

Depth of field, focus, scale and the layering of elements create and define a unified language across the UI. Dimension is the space in which we will create, build and continually evolve.